New Delhi: The Nationwide Firm Legislation Tribunal’s (NCLT) Chandigarh department on Wednesday cleared the scheme of merger between client items big GlaxoSmithKline Shopper Healthcare (GSKCH) and Hindustan Unilever. This clears the decks for GSK Plc to money out its 5.7 per cent stake in Hindustan Unilever (HUL) making it doubtlessly the most important block commerce in India.

New Delhi: The Nationwide Firm Legislation Tribunal’s (NCLT) Chandigarh department on Wednesday cleared the scheme of merger between client items big GlaxoSmithKline Shopper Healthcare (GSKCH) and Hindustan Unilever. This clears the decks for GSK Plc to money out its 5.7 per cent stake in Hindustan Unilever (HUL) making it doubtlessly the most important block commerce in India.Officers conscious of the developments say Morgan Stanley is readying the share sale course of, ET had reported on December 16.

“The efficient date of the merger shall be communicated to the inventory exchanges upon being finalised in accordance with the process said beneath the authorized Scheme of Amalgamation,” GSK mentioned in a BSE submitting Wednesday night.

In December 2018, the Anglo-Dutch Unilever had introduced that it was buying the well being meals portfolio of GSK, together with standard well being drink manufacturers Horlicks and Enhance in India and over 20 different markets for £3.1 billion (about Rs 27,750 crore).

A GSK Plc spokesperson had mentioned in a remark to ET late final yr that the corporate was working in direction of completion of the divestment within the first quarter of 2020, topic to of regulatory approvals.

Following the completion of the transaction, GSK intends to promote down its holding in HUL, in tranches, he had mentioned.

On the time of the deal announcement in December 2018, GSKCH was valued at Rs 31,700 crore, and its shareholders had been to obtain 4.39 shares of HUL for every of their shares. After the merger, that was to get accomplished in a yr, GSK Plc was to turn into the second-largest shareholder within the merged entity with 5.7 per cent stake whereas Unilever’s holding in HUL was to fall from 67.2 per cent to 61.9 per cent.

HUL, India’s largest pure play client items firm, will drive large price synergies with the GSK merger. The merger consists of all of the operations inside GlaxoSmithKline India’s client healthcare vertical.

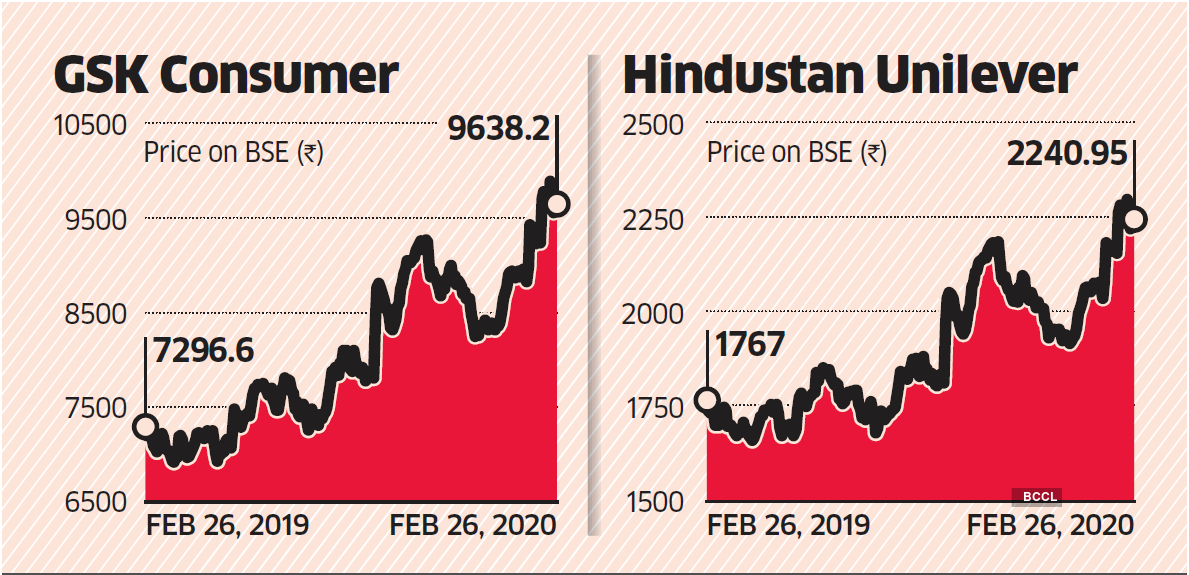

On completion of the merger, GSK’s 5.7 per cent stake, based mostly on the HUL’s Friday shut of Rs 2,240.95 per share, may very well be valued at Rs 27,650 crore on an expanded fairness base.

0 Comments